19.05.2018

Corporate and Personal taxes in the UK (3): Double Tax Treaties

This entry was drafted by McCarthy Denning Law Firm for”E-IURE COMPENDIUM” 2018. Link to e-IURE Network.

This collaboration is a brief step-by-step guidance. In no case it can be considered as legal advice. If you want -or need – legal advice, ask for a lawyer or a law firm. In that case “McCarthy Denning” is an excellent option in the United Kingdom.

This is the third part of Corporate and Personal taxes in the UK. If you want to read the first part, click here.

Double Tax Treaties

Treaty and Non Treaty Withholding Taxes (‘WHT’)

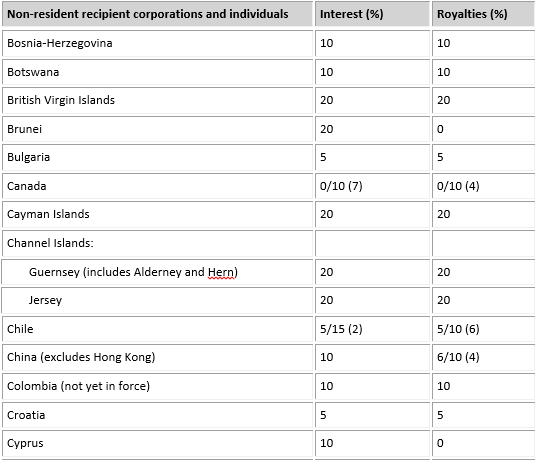

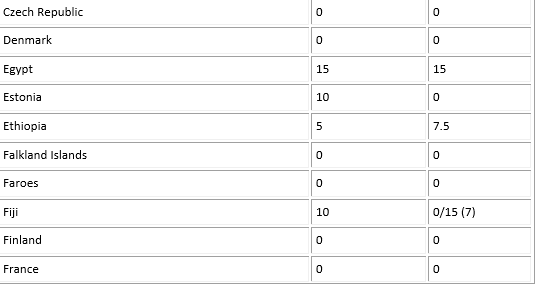

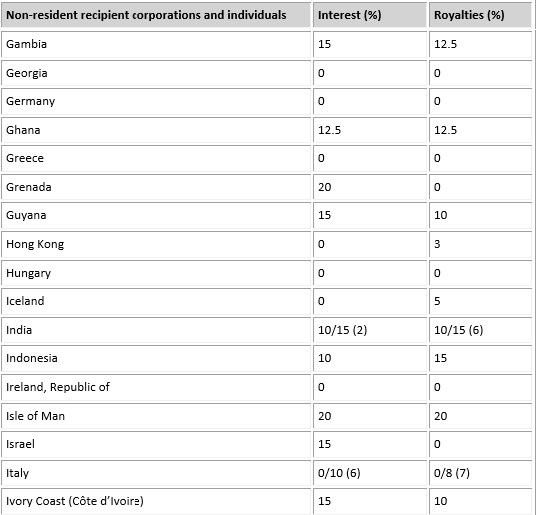

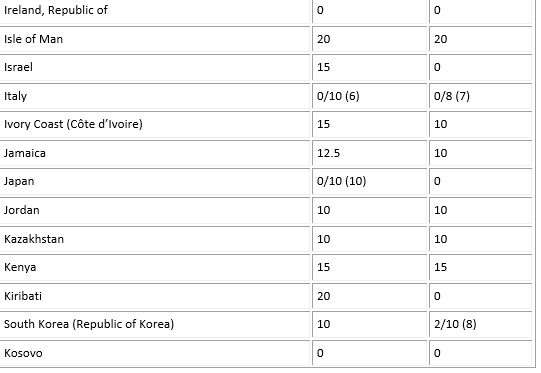

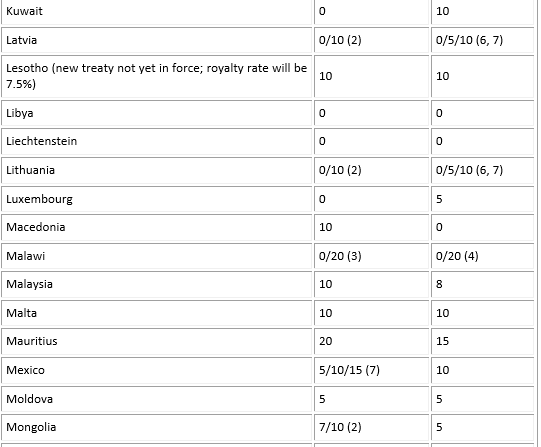

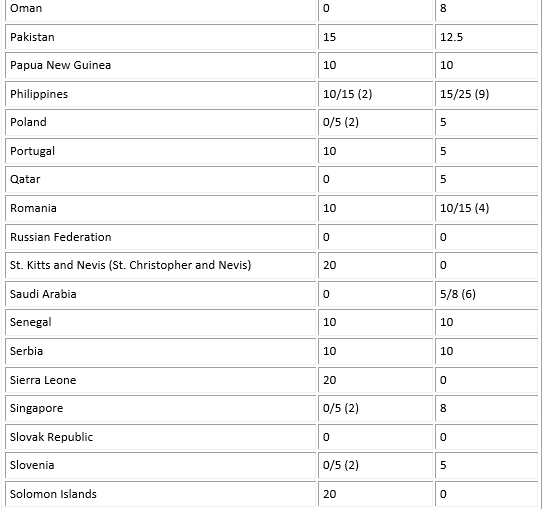

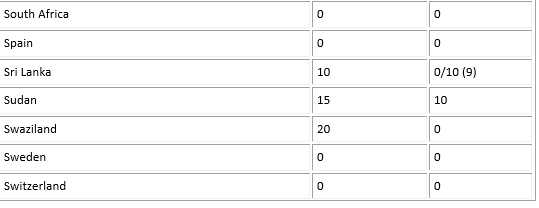

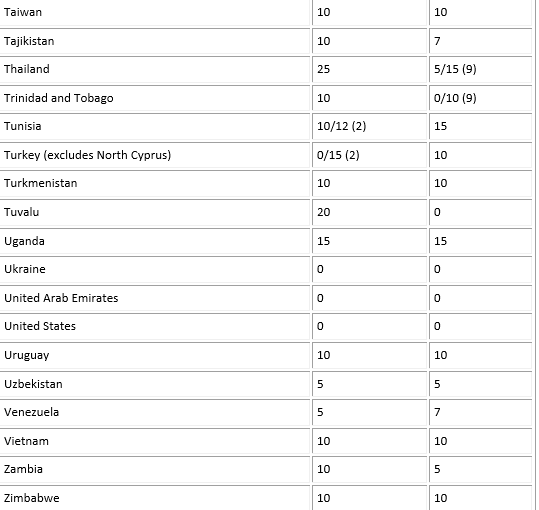

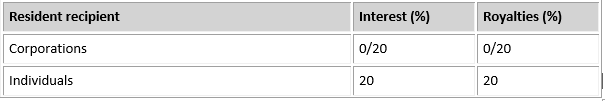

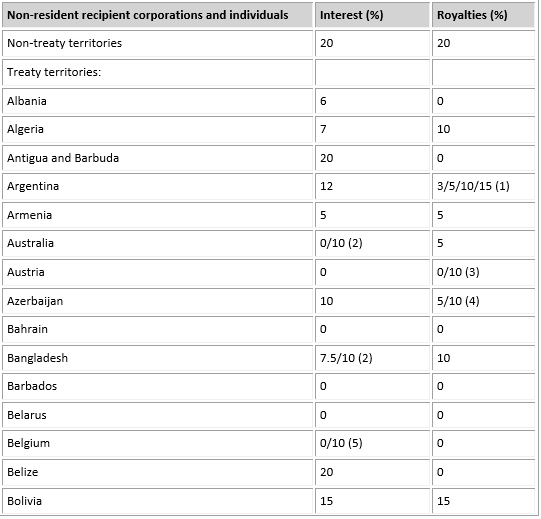

The following chart contains the WHTs that are applicable to interest and royalty payments by UK companies to non-residents under the tax treaties currently in force. Where, in a particular case, a treaty rate is higher than the domestic rate, the latter is applicable. There is no withholding tax on dividends.

Relief at source may be granted on application. Please note that payments of interest and royalties to any UK resident company can be made free of WHT if the recipient is chargeable to tax on the interest or royalty.

Resident recipients

Non-resident recipients

Notes

UK domestic law generally charges WHT on patent, copyright, and design royalties, although there can be definitional uncertainties. Many treaties allow reduced rates for a wider range of royalties. These are mentioned in this table, even though there may be no UK WHT applied under domestic law.

1. 3% for news; 5% for copyright; 10% industrial; 15% other royalties.

2. Lower rate for loans from banks and financial institutions.

3. Higher rate applies if recipient controls more than 50% of payer.

4. Lower rate applies to copyright royalties.

5. 0% on loans between businesses.

6. Lower rate applies to industrial, commercial royalties.

7. Specific additional conditions apply for lower rate.

8. Lower rate applies for equipment royalties.

9. Lower rate applies to films, TV, and radio.

10. Higher rate applies to certain profit related interest.